رابط تحميل كل النماذج في اخر المقال

في اخر المقال رابط تحميل 14 نموذج

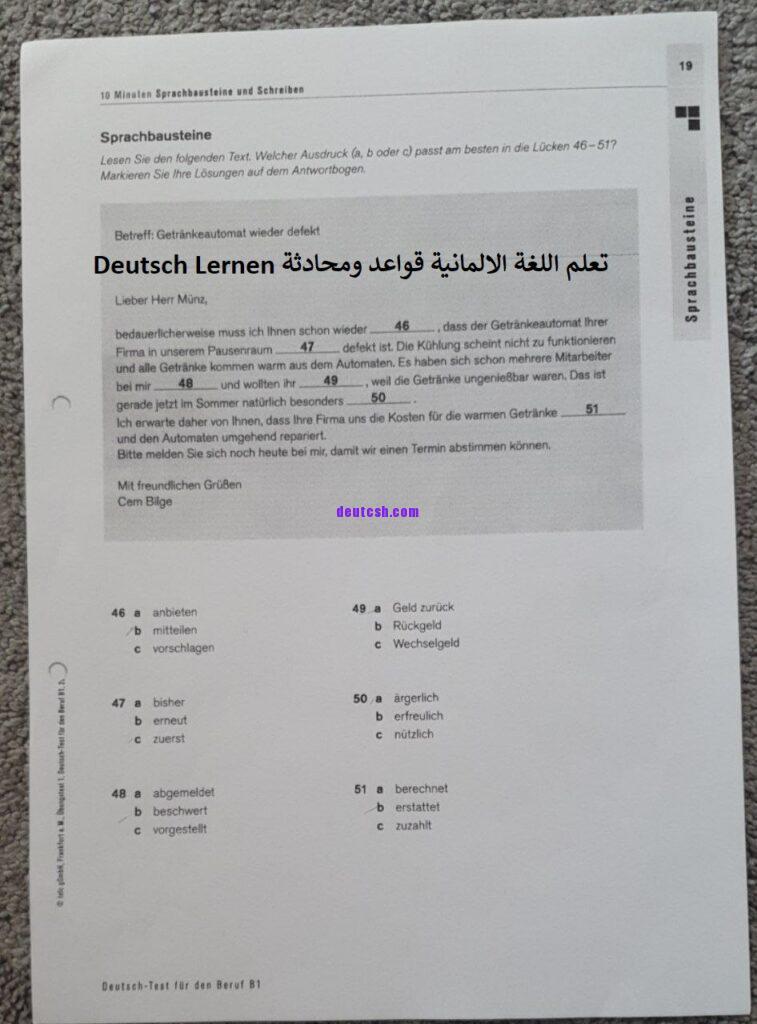

Zertifikat Deutsch / telc Deutsch B1

Review of the EU Motor Insurance Directive

While the revision of the EU Motor Insurance Directive concluded in December 2021, there are two issues that require follow-up work: the question of the protection afforded should a driver’s insurer become insolvent, notably in cross-border cases, and some technical aspects of the standardised claims-history statement, a document that insurers have to provide to policyholders on request.

As regards the former, the Council of Bureaux is currently drafting insolvency agreements, which will then be submitted to the European Commission. As for the latter, Insurance Europe is keen to engage with EU policymakers to ensure that the future claims-history statement is a practical tool that provides real benefits to consumers without placing an undue burden on insurers.

Health insurance

Growing role for health insurers

Private health insurers provide individuals or groups with a range of services to supplement, complement or sometimes replace publicly financed healthcare. Policies cover the medical costs of illness or accidents. In some cases, they offer other elements, such as critical illness or disability cover.

The role of private health insurers is becoming ever more significant as a result of Europe’s ageing populations and increasing strains on national healthcare systems.

EU member states are responsible for the organisation of their healthcare systems. Nevertheless, legislative developments at European level can have a significant direct or indirect impact on private health insurers, so Insurance Europe monitors and engages in any EU-level developments.

Insurance Europe’s mission is:

- To draw attention to issues of strategic interest to all European insurers and reinsurers in a sustainable manner.

- To raise awareness of insurers’ and reinsurers’ roles in providing insurance protection and security to the community as well as in contributing to economic growth and development.

- To promote – as the expert and representative voice of the insurance industry – a competitive and open market to the benefit of the European consumer as well as corporate clients.

In order to achieve this, Insurance Europe:

- Represents all European insurers and reinsurers.

Insurance Europe is the European insurance and reinsurance federation. Through its member bodies comprising of national insurance associations, Insurance Europe represents all types of insurance and reinsurance undertakings, including pan-European companies, monoliners, mutuals or SMEs. Insurance Europe represents undertakings that account for around 95% of total European premium income.

- Positions the European insurance industry within the European and global regulatory frameworks.

Insurance Europe is the voice of the European insurance industry at European and international level. Insurance Europe is a fair and reliable partner and a contact point for institutions, politicians and supervisors. Insurance Europe provides services to the European and International institutions to the benefit of its members. In the regulatory process Insurance Europe develops, promotes and defends industry positions that are supported by technical research and expertise. Through government lobby, public affairs, industry forums and issue management, it contributes to achieve a positive political, social, business and economic environment.

Um die Anwendung von hier herunterzuladen